Die Zentralisierung der digitalen Welt ist in vollem Gange. Anbieter sogenannter Cloud-Dienstleistungen ermöglichen es Unternehmen, ihre IT-Infrastruktur auszulagern oder Rechenleistung und Speicherplatz flexibel anzumieten. Auch der Endverbraucher profitiert trotz Datenschutzbedenken von dieser Entwicklung: Wer zum Beispiel Microsoft als Betriebssystem nutzt, kann die nötige Software anmieten statt sie zu kaufen und seine Dateien auf einem externen Server ablegen.

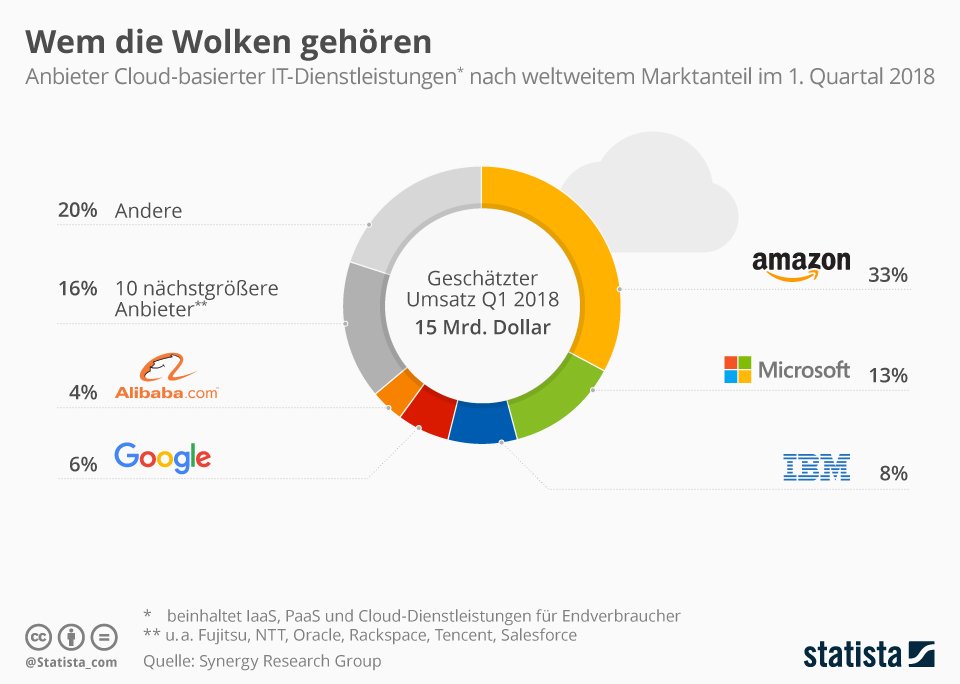

Wie unsere Infografik mit Daten der Synergy Research Group zeigt, tummeln sich wie in anderen Bereichen der digitalen Wirtschaft auch hier bekannte Größen; allen voran Amazon, Microsoft, IBM und Google, aber auch das chinesische Pendant zu Amazon, Alibaba, ist unter den fünf größten Anbietern, die zusammen einen Marktanteil von 64 Prozent haben. Dyfed Loesche

Cloud Growth Rate Increased Again in Q1; Amazon Maintains Market Share Dominance

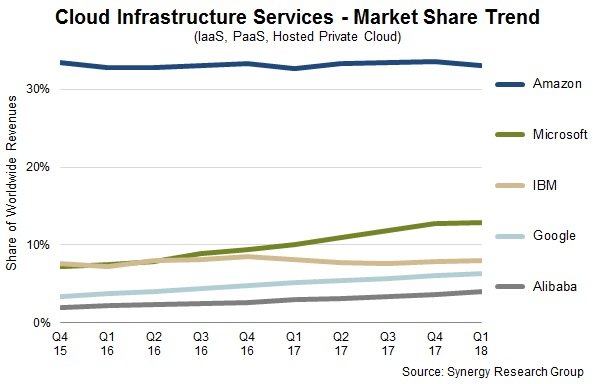

New Q1 data from Synergy Research Group shows that spend on cloud infrastructure services jumped 51 % from the first quarter of 2017, comfortably beating the growth rates achieved in the previous five quarters. Market leader Amazon was a major contributing factor, as growth of its AWS division was also the highest achieved since late 2016. AWS worldwide market share has held steady at around 33 % for twelve quarters now, even as the market has almost tripled in size.

As the cloud boom continues, Microsoft, Google and Alibaba have all substantially grown their market shares, but this has not been at the expense of AWS. It is the small-to-medium sized cloud operators who collectively have seen their market shares diminish. Meanwhile IBM market share has been relatively stable at around 8 %, thanks primarily to its strong leadership in hosted private cloud services.

With most of the major cloud providers having now released their earnings data for Q1, Synergy estimates that quarterly cloud infrastructure service revenues (including IaaS, PaaS and hosted private cloud services) have now reached almost $15 billion. The Q1 growth rate of 51 % compares with a full-year 2017 growth rate of 44 % and a 2016 growth rate of 50 %. Public IaaS and PaaS services account for the bulk of the market and those grew by 56 % in Q1. In public cloud the dominance of the top five providers is even more pronounced, as they control almost three quarters of the market.

»Cloud growth in the last two quarters really has been quite exceptional,« said John Dinsdale, a Chief Analyst and Research Director at Synergy Research Group. »Normal market development cycles and the law of large numbers should result in growth rates that slowly diminish – and that is what we saw in late 2016 and through most of 2017. But the growth rate jumped by three percentage points in Q4 and by another five in Q1. That is good news for the leading cloud providers, whose historically high levels of capex are helping to ensure that they are the main beneficiaries of that exceptional market growth.«

Top-Themen der Digitalwirtschaft 2018: IT-Sicherheit, Cloud Computing und Internet der Dinge

Studie Public Cloud Computing – Wie werden Computing Services in Unternehmen genutzt und gesteuert?